Helping Magento Merchants

We are in unchartered waters. The global pandemic and related impacts are affecting every aspect of our lives. These include social distancing, trying to find basic supplies, and the loss of customers and revenue for businesses of all sizes. These are scary times. But these are also times in which we need each other more than ever, and businesses need our support now in order to be around tomorrow. In these difficult times, we look for the little things we can do to support each other.

Bank Consolidation and the Entry of Fintechs

Bank consolidation from 1990-2009 saw more than 37 regional banks consolidate into four banking institutions.

Small businesses generate 60% of all net new jobs.1 Sixty-one percent of small businesses turn to loans for growth.1 There is a clear correlation between a small business owner’s ability to hire and their ability to get financing.2 However, bank consolidation contributed to a 15% decline in the number of bank loans from 2005 to 2016.1

Fintechs are filling the void. While fintech loans generally have a higher cost than a bank loan, the trade-off is that fintech loans are typically faster, require less documentation and are sometimes available when bank loans are not available. Businesses considering loans should always ask about the full cost of a loan, including the loan fee, as well as additional fees such as origination, early repayment, late payment and other fees.

In the current economic environment, many fintechs may reduce lending, stop lending or, in some cases, go out of business. There is hope, however, as the federal government is allowing fintechs to participate as a distributor for new loan programs, including the Paycheck Protection Program. This program is backed by the Small Business Administration (SBA) and generally allows businesses up to 500 employees to apply for a loan equal to $1,000 times the number of employees times three months. If a business has 15 employees, that business could apply for a loan of up to $45,000 to cover payroll expenses.

Transition

While most of us are social distancing, working from home and taking other precautions, business is continuing for many. I am a volunteer firefighter and when a fire, accident or medical emergency occurs, I need to be available to respond as an essential service. Those working from home still need supplies and, as a result, online shopping has become extremely important. As an example, Amazon stock hit a low of $1,676 per share on March 12 and crossed over $1,900 per share on March 23.

Magento merchants have a broad online presence and may be feeling the impacts of the current shift to online shopping and services. Other Magento merchants may be in the “essential business” category and forging ahead despite the headwinds. And yet others may be feeling the effects of the economic downturn and not sure where to turn. Layer on top of this, the Magento 2 migration and associated expenses, and it can feel bleak.

Help is on the way. The government is fast-tracking the new SBA programs. $350 billion has been allocated to help a program that typically lends $20 billion annually.

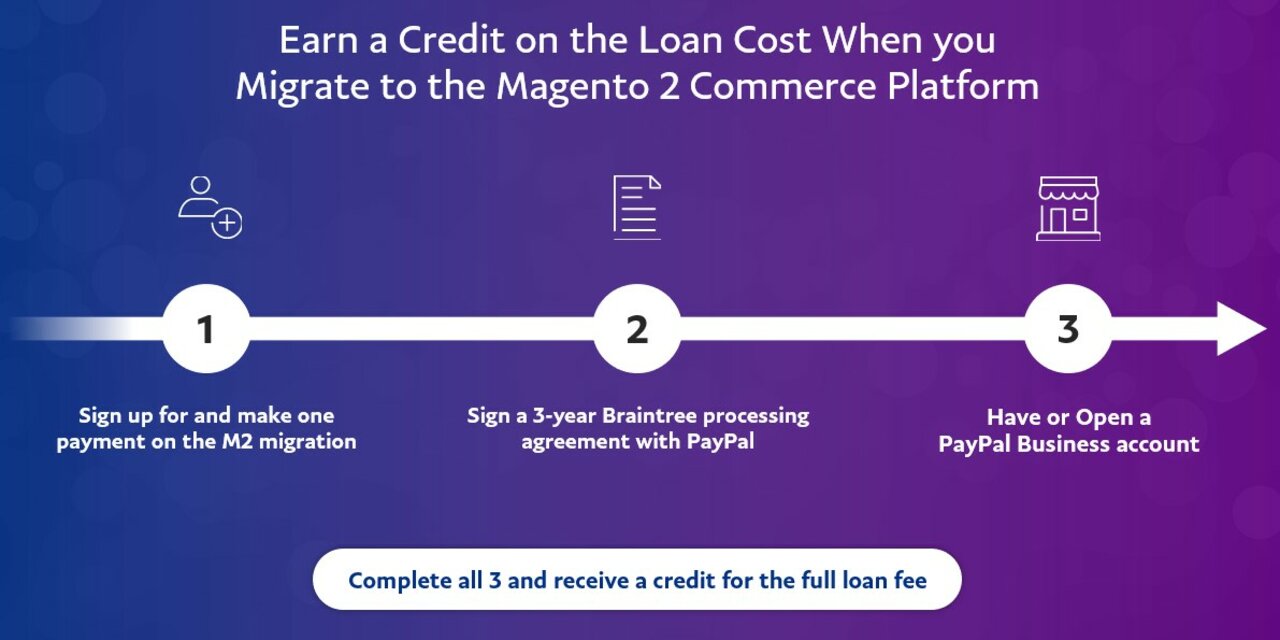

For the Magento 2 migration, Magento has partnered with PayPal to provide the ability to borrow money with a full rebate for the cost of the loan if the business migrating does three things:

- Signs up for and make one payment on the M2 migration.

- Signs a three-year Braintree processing agreement with PayPal and processes with Braintree for three months.

- Have or open a PayPal business account.

We are all reacting to the current economic environment. Magento and PayPal are exploring other lending programs to help provide capital to Magento merchants. We must be committed to taking care of ourselves and helping each other. And business lending programs are a small step in that direction.

1Mills, Karen G. 2016 “The State of Small Business Lending: Innovation and Technology and the Implications for Regulation.”

2McCracken, Todd “National Small Business Administration 2017 Mid-Year Economic Report.”