The Buy Now Pay Later Boom in the Magento World

First thing’s first: What is Buy Now Pay Later, or BNPL? Buy Now Pay Later is a solution that allows consumers to purchase an item today but only pay either in full after they received their item (14 or 30 days), or in installments, i.e., equal repayment, set over a period of time spanning from 30 days to 60 months, often with interest as low as 0%.

Although BNPL can be offered in physical stores or online, technology allows the credit application to be quick and easy online. BNPL can also be used through an app for offline stores.

As the best alternative to Magento 2 default checkout, OneStepCheckout has experienced growing demand from Magento 2 store owners to integrate with Buy Now Pay Later payment options.

Accelerated Growth of BNPL During the COVID-19 Pandemic

Online shopping grew extremely fast over the last year due to the COVID-19 pandemic. BNPL benefited from the overall expansion of e-commerce. In addition, the pandemic impacted millions of jobs and many households’ budgets are tighter than ever. According to research from Mercator Advisory Group, interest-free installments allow customers to keep cash in case of an emergency as well as make up for lost income.

Globally, BNPL players experienced tremendous growth rates in terms of payment volume, active consumers and merchant partners. Here are key stats covering the top four Magento markets in this space:

United States

No surprise, the United States is the second largest e-commerce market in the world (behind China) and the top Magento market. A study from The Ascent shows that adoption of BNPL grew over 50% between July 2020 and March 2021 and that, today, more than half of U.S. adults have used Buy Now Pay Later.

United Kingdom

The United Kingdom is the third largest e-commerce market in the world and the largest in Europe. Based on a review from the Financial Conduct Authority, adoption of BNPL products nearly quadrupled in 2020 and is now at £2.7 billion, with 5 million people using these products since the beginning of the coronavirus pandemic. BNPL transactions are expected to grow by almost 30% over the next four years, doubling the BNPL share of U.K. e-commerce to a reach total of 10%.

The Netherlands

With only 16 million inhabitants, the Netherlands is nevertheless one of the top four Magento markets with the highest number of Magento stores and Magento developers per capita. According to a 2020 Survey, BNPL payment is expected to grow by 52.1% to reach $1.6 billion (USD) in 2021 and is forecasted to grow at a steady 17% over the next 8 years.

Australia

Although Australia might not be as big of a market as Germany, for example, it stands out because most Buy Now Pay Later companies were founded there, with half a dozen listed on the Australian Security Exchange, including Openpay, Afterpay, Zip, Laybuy, Splitit and even U.S.-based Sezzle.

These companies’ performances alone already provide a good indicator of the market’s health. According to the Reserve Bank of Australia, BNPL transactions grew by around 55% between 2019 and 2020 and have tripled since 2017 to reach over $9bn AUD (approximately $7 billion USD) in 2020.

Why BNPL Adoption is Growing among Magento Merchants

Merchant adoption of BNPL is driven by the rapid adoption of consumers who find the function convenient and cost effective. In fact, although the merchants’ fees might be higher than when offering credit and debit card payment, BNPL providers — such as Zip and Afterpay — substantiate benefits like:

- Attracting new customers

- Improving conversion at checkout (+20% to 30% on average)

- Increasing the average order value or basket size (+40% up to +85%), and

- Increasing repurchase rate (up to 80%).

Plus, BNPL providers will:

- Pay the merchant right away and bear the consumer credit risk

- Promote the merchant among its members network (13 million global consumers for AfterPay, 90 million active consumers for Klarna)

- Offer additional services such as marketing, customer referrals, analytics and more.

BNPL in the World of Magento (Adobe Commerce)

PayPal

Magento users might have noticed PayPal’s “Pay in 4” appearance on the top banner of Magento Marketplace.

Indeed, PayPal launched their BNPL product in 2020 in the U.S., U.K. and France. By Q4 2020 the product was used by 3 million unique consumers, generating $750 million payment volume through 250K unique merchants.

Klarna

Klarna payments have been bundled with the Magento core product since the release of Magento 2.2.4.

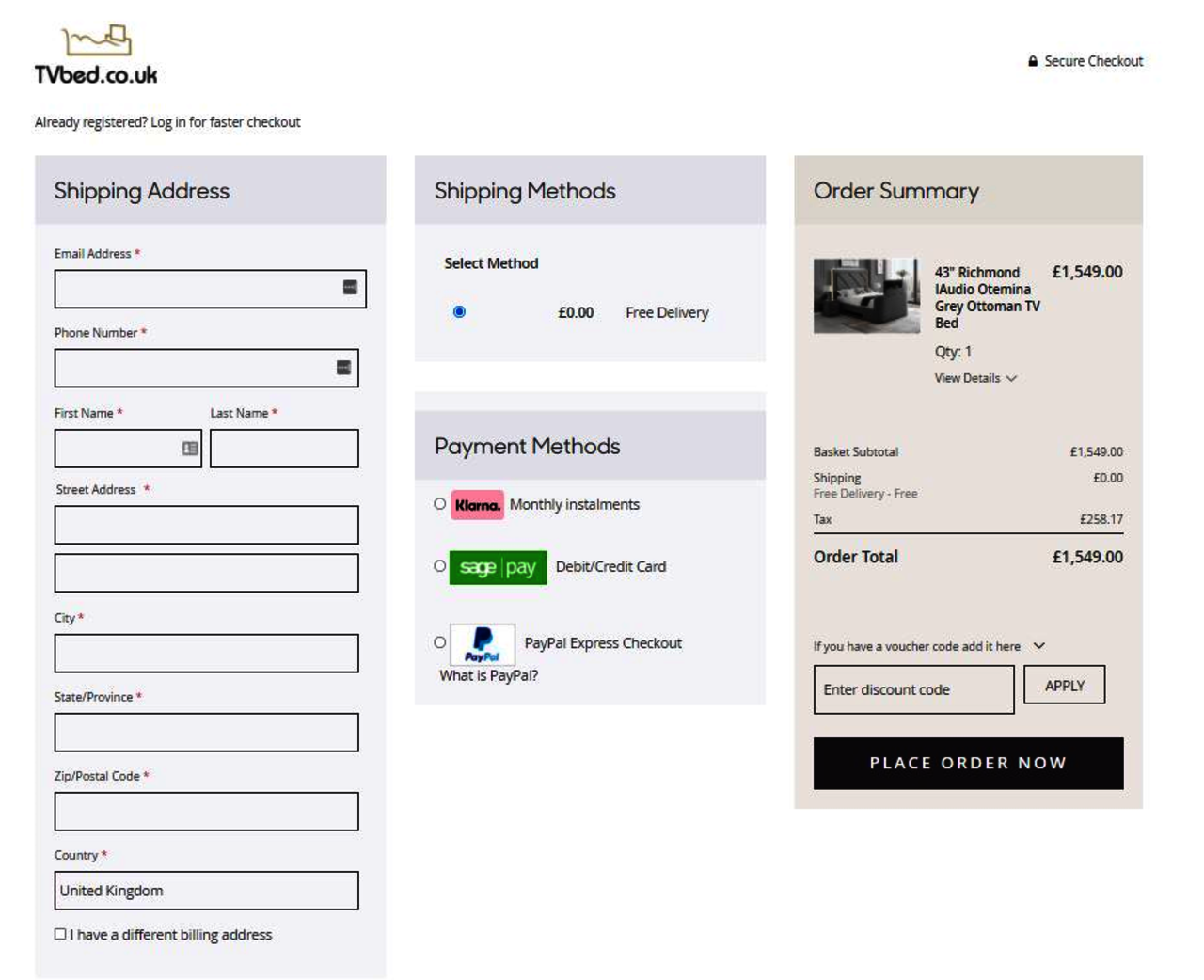

The Swedish company is, as of June 2021, the top European tech unicorn with a valuation of $46 billion (USD). Klarna operates in 17 markets across North America, APAC and Europe. For example, TV Bed, a division of Nestco Ltd., is a Magento 2 store selling luxury, high-tech beds and offers Klarna installments through its site.

Zip and Quadpay

Zip announced that it became an Adobe Accelerate Partner in April 2021.

This is an Australian company that also operates in New Zealand and the U.K. via PartPay, and in the U.S. after the acquisition of New York-based Quadpay. They are also minority shareholders in Payflex in South Africa, Twisto in the Czech Republic and Spotii in the UAE.

For Q1 2021, the company recorded a transaction volume growth of 141% versus the previous year, annualizing $7.5bn AUD.

Openpay

Openpay is yet another Australian company expanding in the U.K. and U.S. (under the OpyPay brand), with partnerships such as ezyVet, the largest network of veterinary practices. Openpay is making its debut in the Magento ecosystem the same way as many before it, through partnerships with well-established technology vendors.

Openpay’s key difference is their consumer demographics and presence in different industry verticals. Their active customers are older with more disposable income and can purchase higher-price-point items. In 2020, Openpay reported high growth in top categories such as their auto business (+100%), health care (+127%) and retail (+260%).

MultiSafepay

MultiSafepay is a payment service provider that was founded in Amsterdam in 1999. They offer their own Pay After Delivery Service (Betaal na Ontvangs) as well as other BNPL options, such as AfterPay NL and Klarna. Magento is its biggest e-commerce platform: MultiSafepay has its own channel within Magento Community Engineering Slack and are joining the Extension Developers Network in 2021.

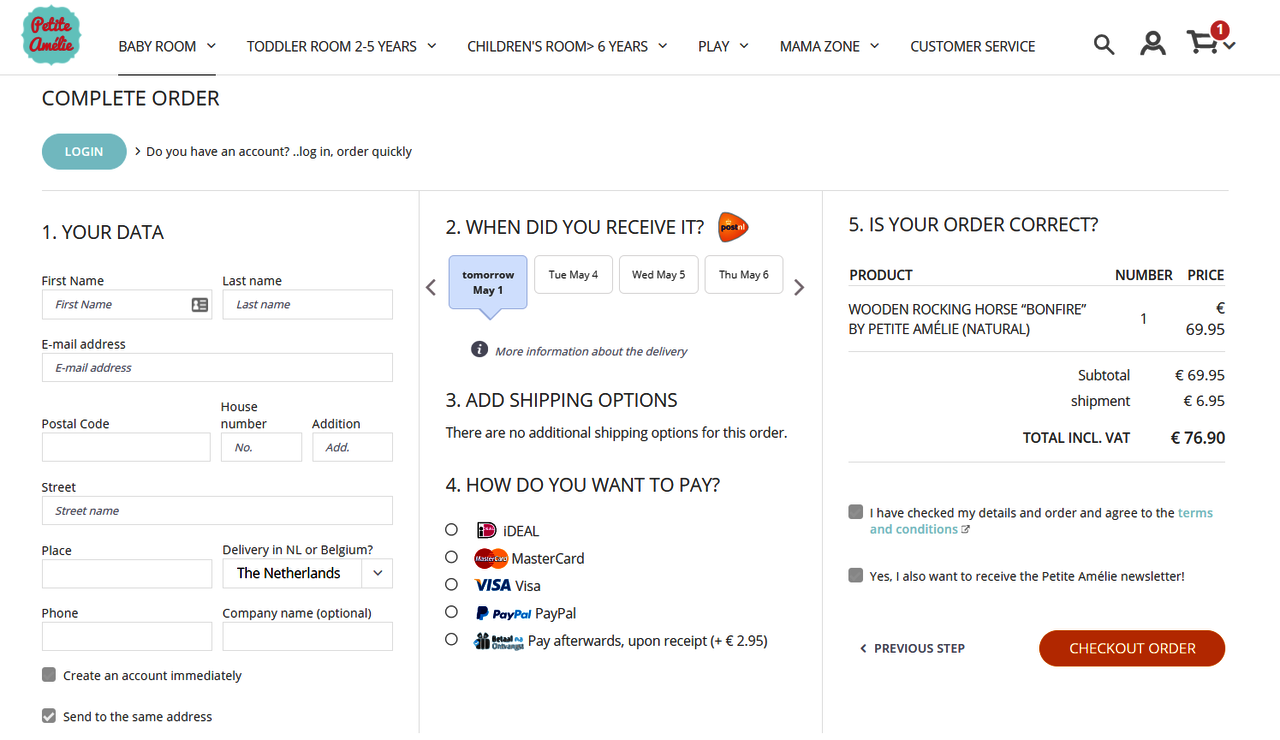

As an example, Petite Amélie is a company selling children’s furniture and décor in the Netherlands and offers MultiSafepay’s Pay After Delivery option on their Magento 1 store.

Learn more with a practical example of how a solution like Openpay combined with OneStepCheckout can further boost your Magento 2 store’s checkout conversion.