The Digital Wallet Is Here to Stay

This article was originally published on the Google Developers Blog.

Digital wallets are rapidly growing in popularity, as adoption from users and acceptance from businesses has expanded significantly over recent years. As we have seen in recent months, this trend toward digital payments over traditional card or cash transactions has only accelerated during the COVID-19 pandemic. Over 40% of global ecommerce spending in 2019 came from a digital wallet like Google Pay, Apple Pay or Alipay according to the FIS Global Payments Report.1 This year, over one billion shoppers are expected to make a digital wallet transaction.

We believe this is just the beginning. In the next five years, digital wallet adoption is expected to increase dramatically. Worldpay’s white paper explores how adopting digital wallets can benefit businesses like yours. Some of the key takeaways are highlighted below.

What Digital Wallets Have to Offer

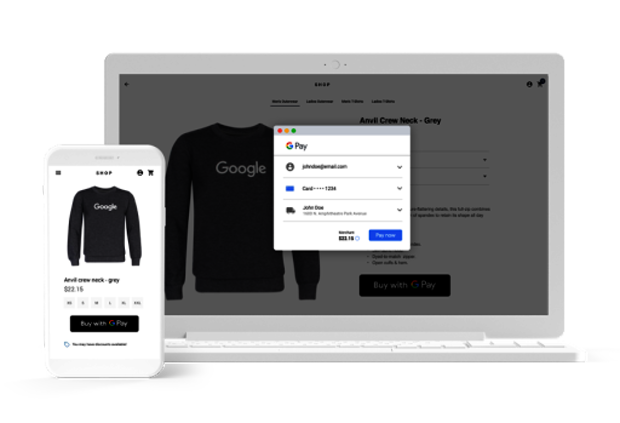

Digital wallets, such as Google Pay, have the ability to not only improve your business outcomes, but also provide unique value to everyday consumers. Benefits include:

- Higher conversion rates

- Seamless checkout experience

- Reduced cart abandonment

- Advanced security and protection

Digital Wallets vs. Ordinary Card Transactions

Real tangible benefits are found when businesses adopt a digital wallet. Findings include:

- Digital wallet transactions showed significantly higher acceptance rates and significantly lower chargeback rates for businesses compared with ordinary card transactions.2

- Even though transaction volumes for digital wallets were lower than cards in most markets, the value of U.S. digital wallet transactions were on average 25% greater than ordinary card transactions in 2019.2

How to Bring Google Pay Into Your Business

Ready to adopt a digital wallet and give your customers a seamless transaction experience in just four easy steps? Sign up with the Business Console here and visit our developer's site for more information. You can also find the full white paper here, alongside previous case studies that prove how Google Pay has helped drive lasting impact for other businesses.

We continue to build partnerships with top e-commerce platforms to help you easily integrate Google Pay. Please see the Google Pay plugin for Magento 2, Shopify, Big Commerce, WooCommerce and OpenCart.

Liked our white paper? Reach out directly to the contacts below.

Google:

Steve Klebe

Head of PSP Partnerships, Google Pay

sklebe@google.com

Worldpay:

Rami Josef

Senior Product Manager, Worldpay

rami.josef@fisglobal.com

Resources:

- Worldpay by FIS Global Payments Report

- Sourced from Worldpay’s Worldwide Payments Gateway (WPG) using data from Q4 2018 through Q1 2020

Do you have any questions? Let us know on Twitter using #AskGooglePayDev.