Finding the Right Digital B2B Payment Provider — 7 Key Considerations

COVID-19 didn’t revolutionize the digital business landscape. The pandemic simply accelerated the adoption of existing digital technologies and processes. For example, digital payments for e-commerce and mobile point-of-sale (POS) solutions transformed expectations for business-to-consumer (B2C) transactions years ago, and those expectations were already driving adoption for digital payments across business-to-business (B2B) transactions by 2019.

Though COVID-19 didn’t trigger these changes, it did cement them. These days, we can all agree that digital payments are no longer an optional convenience for B2B sales. Today’s vast majority of businesses must transition to digital payment options — and soon — so they can maintain their competitive stance.

Selecting a B2B Digital Payment Solution? Research Pays Off.

If your business is in the process of selecting a B2B digital payment provider, you have probably already realized that you face high stakes. Choosing the wrong payment solution can increase your costs, reduce your margins and negatively impact your customer satisfaction. Some of you may have already experienced these issues and urgently need to select a new solution.

Fortunately, doing your research pays off. By simply avoiding the most common issues, you can save yourself from headaches, hassles and high costs.

Whether you’re selecting a digital payment solution provider for the first time or need to fix a prior choice that isn’t working out, make sure your new payment provider delivers across seven key areas.

1. Integration

Manually driven legacy processes are time-consuming and costly. According to PYMNTS.com, manual invoicing processes can cost businesses $171,000 per year and 125 hours a week.

To reduce manual processes, ensure that the payment provider you are considering integrates with financial data from your enterprise resource planning (ERP), e-commerce, POS and mobile applications.

2. Uptime

Payment processing downtime is also costly. Gartner states that each minute of downtime can cost your business upwards of $5,600, and IHS Markit reports that businesses could be losing around $700 billion every year due to IT downtime.

When digitizing payments for B2B transactions, choose a provider with 99% uptime at least. Anything less than that is unacceptable in today’s world.

3. 24/7/365 Live Support

It is inevitable that, sometimes, your business will need help processing a payment.

When you choose a payment provider with a 24/7/365 live support team and your own dedicated onboarding and implementation team, you can always count on having a real human being for the support you need, who also understands how your payments integrate with the specific business solutions you use.

4. All-in-One Solution

You have many choices when it comes to selecting a payment provider. Considering one that can be your “one-stop shop” for all your payment needs will pay off in the end. It is a smart choice to select a solution that provides clients with just one redundant gateway that also integrates with all your core business systems, including ERP and e-commerce solutions.

Why? By choosing an all-in-one provider that is integrated, you do not have to log into and reconcile multiple gateways. When more than one gateway is involved, you will have additional transaction costs that increase your cost of processing payments. By utilizing one payment gateway across multiple platforms, you will have the ability to access the same credit card token ID, which will make it easier to issue refunds and voids and process future payments.

5. Ability to Integrate Level 3 Processing

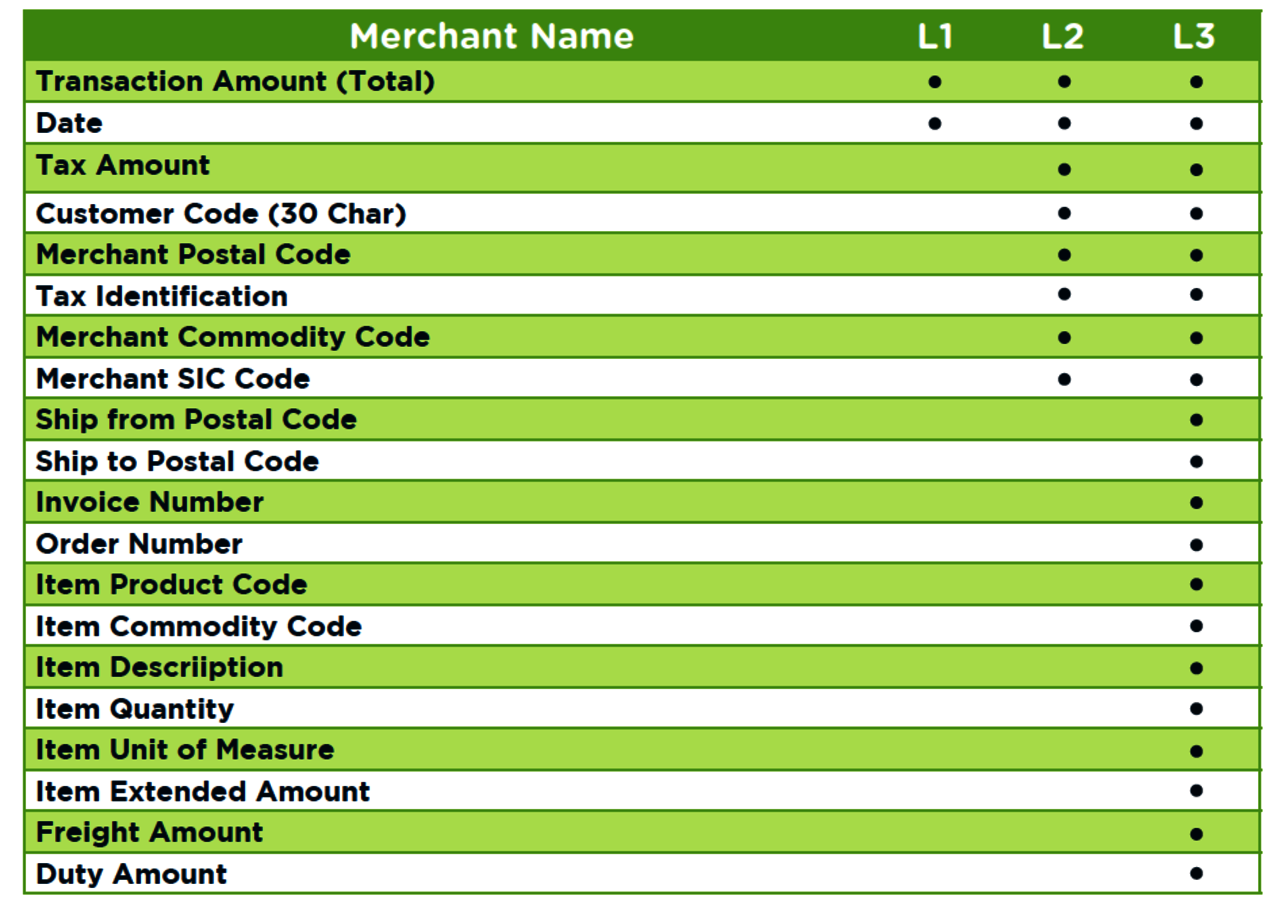

Credit card processing has three levels of data requirements: Level 1 (L1), Level 2 (L2), and Level 3 (L3). Level 2 and Level 3 are for B2B, not B2C, transactions. Each level is defined by how much data is required to process a payment, with Level 1 requiring the least and Level 3 the most.

Level 3 processing empowers companies to significantly reduce their interchange rates, but it isn’t available for flat-rate or tiered-rate credit card pricing models. This means many companies are overpaying on their interchange rates simply because they use the wrong pricing structure.

Look for a provider that offers interchange plus pricing that supports automated Level 3 data processing (see data points below).

6. Digital Payment Capabilities

Digital payments have taken over the modern world. Speed and efficiency in B2B payments are now more important than ever. Businesses are moving to digital payment options to remain competitive by ensuring speed, efficiency, cost effectiveness, security and customer satisfaction.

7. Innovative Payment Technology

Harvard Business Review determined that 73% of customers use multiple in-person and digital channels (including online apps for coupons, in-store price checkers, etc.) during their shopping journeys, and customers who used four or more channels spent 9% more in the store, on average, when compared to those who used just one channel.

Clearly, delivering an omnichannel experience is critical for increasing engagement and closing sales, but achieving true omnichannel flexibility requires that you work with a payment provider that makes it their focus to consistently stay ahead of the curve with innovative payment technology.

Look for a provider that is keeping up with this revolution and offers omnichannel payment technology that supports sales at every touchpoint: in-store, online, on social media, on mobile devices and wherever else your customers happen to be.

Choose the Right Digital B2B Payment Provider for Your Needs

The payment industry is growing at a rapid pace, but not all B2B payment providers are created equal. When you take the time to carefully research your options for providers, you can save time, streamline costs, mitigate risk, improve efficiency and increase the insight you have, so you can successfully grow your business in today’s hypercompetitive world.